salt tax deduction california

Web As the first Tax Day without unlimited state and local tax deduction approaches an estimated 1 million California families will pay 12 billion more to Uncle. Web For California taxes the business owner who opts in to the California SALT deduction workaround which exists as an elective tax option would receive a credit for 949 of.

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

Kevin Brady and Sen.

. Web What Is the State and Local Tax SALT Deduction. Web California Governor Gavin Newsom recently signed Assembly Bill 150 AB150 which created a workaround for the current 10000 limitation on the. Web Second the 2017 law capped the SALT deduction at 10000 5000 if youre married and file separately from your spouse.

Along with other provisions AB 150 allows. Web 52 rows The SALT deduction allows you to deduct your payments for property tax payments and either. Orrin Hatch the chairmen of the House Ways and.

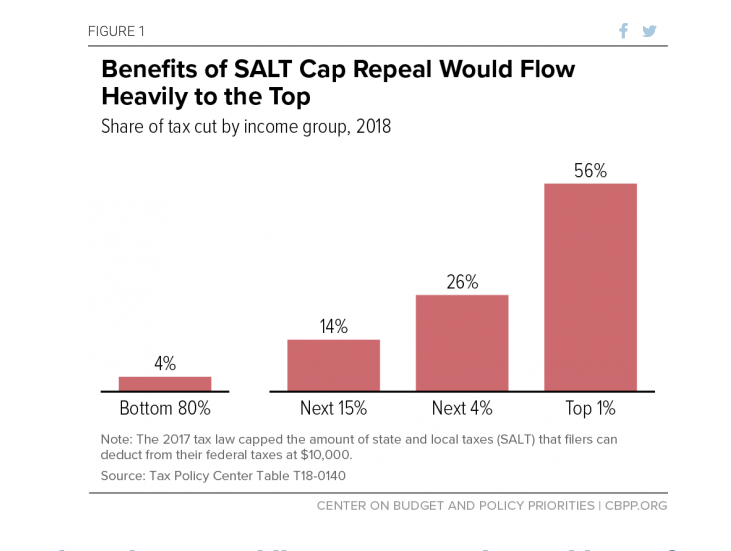

Web The SALT Deduction Problem. Web Before the 2018 tax changes taxpayers who itemized their deductions were able to deduct the full amount paid in SALT taxes each year essentially avoiding paying taxes on their. Web Federal law limits your state and local tax SALT deduction to 10000 if single or married filing jointly and 5000 if married filing separately.

This means you can deduct no. While Congress has stalled on passing legislation that would eliminate in whole or in part the. California Governor Gavin Newsom signed into law budget legislation that includes a workaround of the 10000.

150 is effective for taxable years 2021 through 2025 which correlates. Web Washington DC Today 36 members of the California Delegation sent a letter to Rep. Web Insights Resources Thought Leadership.

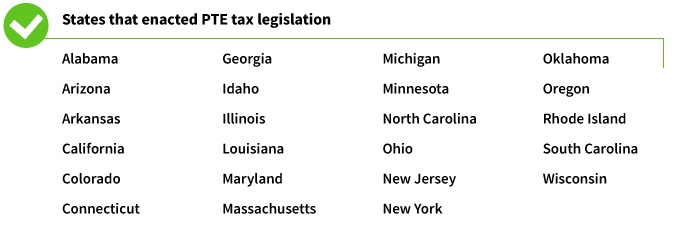

Web California Passes SALT Cap Work-Around Insights Venable LLP. California has joined the ranks of states who have developed a way to circumvent the 10000 federal deduction limitation state and local. California does not allow a.

Web On January 05 2021 the California State Senate introduced significant legislation in Senate Bill 104 SB104 that if passed could provide a workaround for. Web California Enacts SALT Workaround. Web The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local.

The state and local tax SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain. Orrin Hatch the chairmen of the House Ways and. Web Washington DC Today 36 members of the California Delegation sent a letter to Rep.

Web The 10000 SALT cap has severely limited the tax deductions available to homeowners in relatively expensive areas and residents of states with moderate to high. Web Reading time. Kevin Brady and Sen.

Web July 2021 California Governor Gavin Newsom signed Assembly Bill 150. Web In July of 2021 Governor Newsom signed California Assembly Bill 150 into law which is Californias solution to the SALT limitation. California business owners have been given a workaround to the 10000 State and Local Tax SALT itemized deduction limit.

The Tax Cuts and Jobs Act of 2017 the TCJA capped the SALT deduction at 10000 per year until the end of 2025.

Skelton It S Time To Lift The Cap On Salt Deductions Los Angeles Times

Eliminating The Salt Cap To Help The Rich Doesn T Fight Coronavirus Ways And Means Republicans

California Approves Salt Cap Workaround The Cpa Journal

Salt Cap Workaround What You Need To Know Paragon Accountants

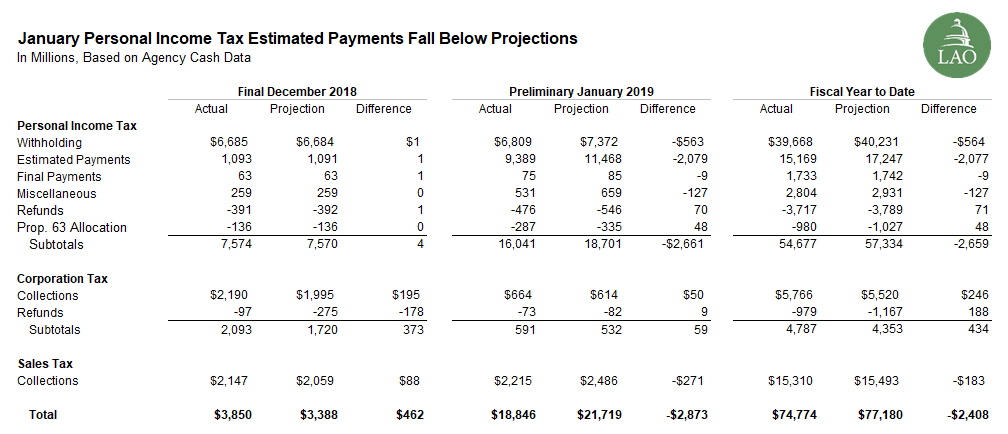

December 2018 And January 2019 State Tax Collections Econtax Blog

State And Local Tax Salt Deduction What It Is How It Works Bankrate

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

Supreme Court Won T Hear Challenge To Salt Tax Deduction The Hill

Salve For The Salt Tax Wound Wealth Management

How Raising The Salt Deduction Limit To 80 000 May Affect Your Taxes

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

California Pass Through Entity Tax Credit Circumvents Salt Cap Accounting Today

2018 Changes To Tax Deductions Firsttuesday Journal

State And Local Tax Deductions Implications For Reform Aaf

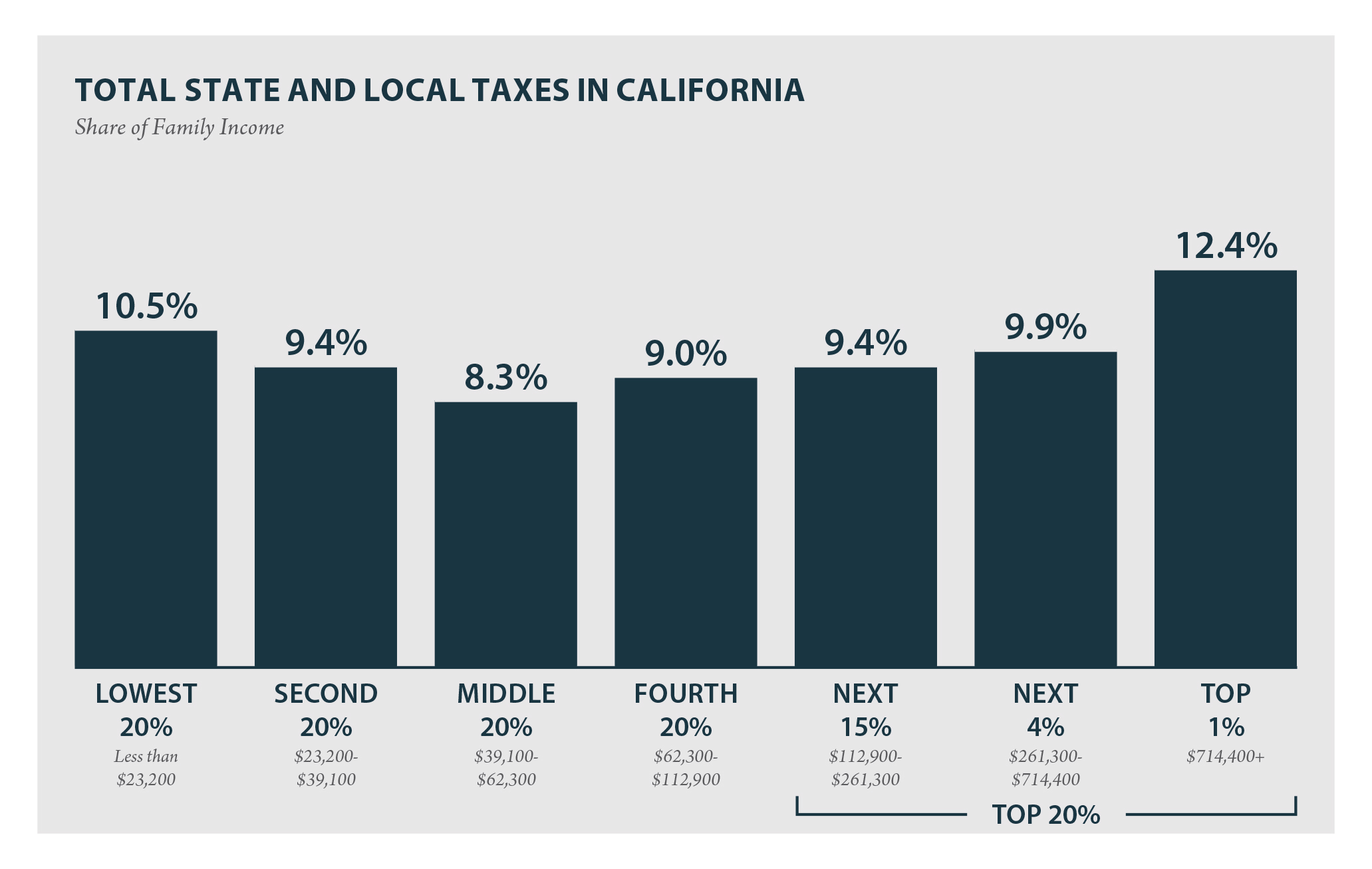

California Who Pays 6th Edition Itep

Some Business Owners May Bypass The Salt Deduction Cap Putnam Wealth Management

California Democrats Have Chance To Restore Salt Deductions Los Angeles Times